……Says budget to achieve macroeconomic goals, good governance

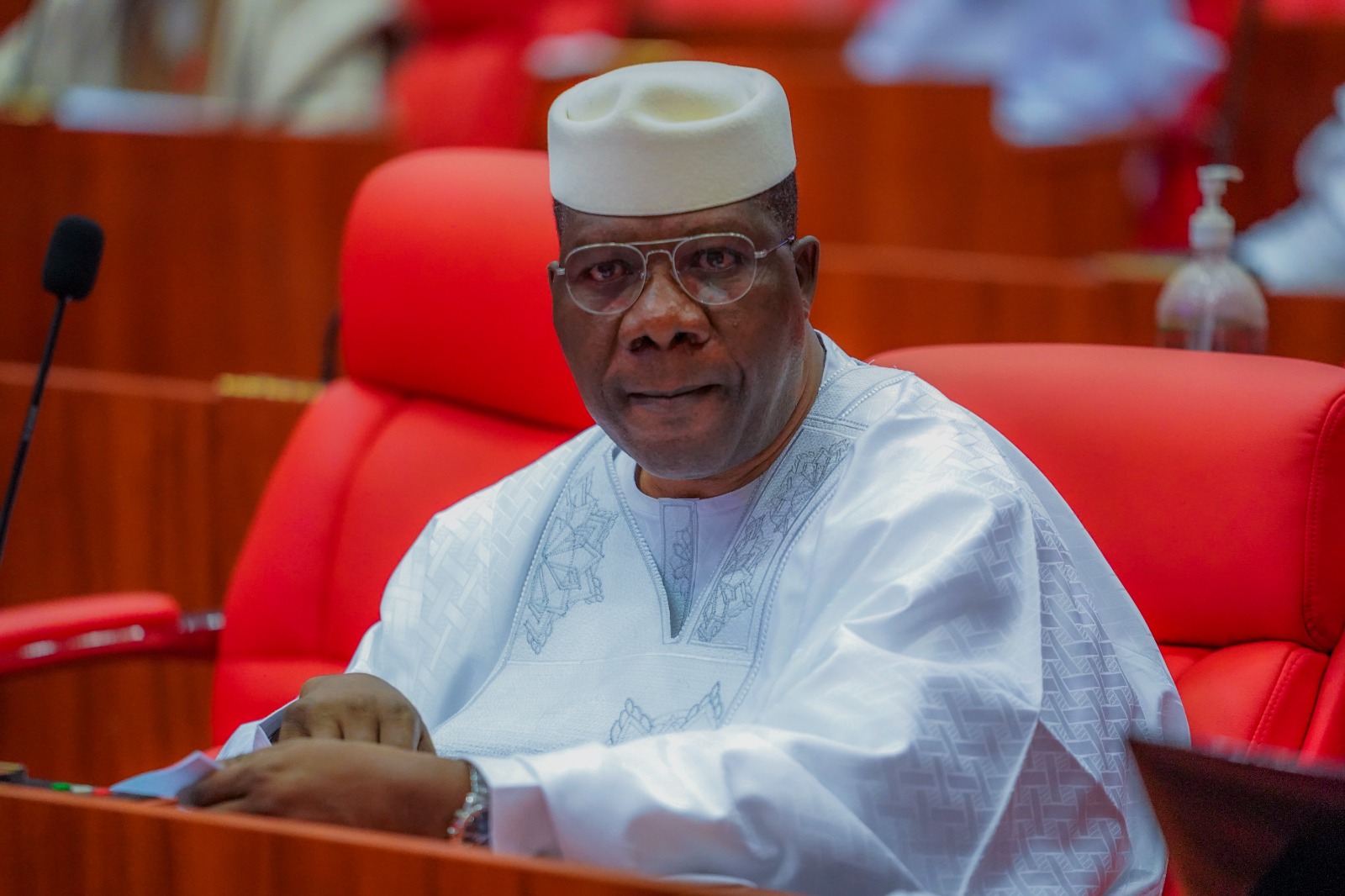

Gov. Yahaya Bello has presented an Appropriation Bill, Budget Outlay of N145.8 billion for the 2022 fiscal year to Kogi House of Assembly for “Frank review and approval.”

Presenting the Appropriation Bill tagged, “Budget of Accelerated Results” to the Assembly on Thursday in Lokoja, Bello said the total Budget was divided into Recurrent Expenditure of N90,151 billion representing 61.79 per cent.

The Capital Expenditure, according to him, is N55.744 billion representing 38.21 per cent adding that the total budget package for year 2022 was N145,896,072,913 as against the N160.560 billion revised budget for year 2021.

“This represents a decrease of N14.664 billion or 9.13 per cent when compared with the 2021 Revised Budget”, he said.

According to the governor, out of the total estimated Recurrent Revenue of N96.792 billion, Estimated Personnel Cost for the period is N45.119 billion whereas N45.031 billion is Overhead Costs, thereby giving N90.151 billion as a total Recurrent Expenditure for the year 2020.

He gave the total budget expenditure outlay as follows: Administration – N50,23 billion representing 34.43 per cent and Economic – N41.926 billion representing 28 per cent.

Others are Law and Justice – N4.720 billion representing 3.24 per cent and Social – N49.015 billion representing 33.6 per cent.

The governor noted that accountability and open governance starts with timely and transparent showcase of government income, proposed expenditure plan and levels of performance and pledged to an honest, realistic and sustained implementation of the year 2020 budget as usual.

“In order to keep this undertaking and avoid derailment by any means, we have factored into this Budget policies, outcomes and targets consistent with those Sustainable Development Goals (SDGs) identified in our blueprint documents as most urgently needed by the larger spectrum of our populace”, he said.

Bello also undertook to on behalf of his administration to complete every single project they started in the 21 Local Government Areas and to pay the contractors and at the same time, cutting down the cost of governance for the benefit of the people.

Speaking earlier, Speaker of the House, Prince Matthew Kolawole described budget as an important policy tool that provides an avenue for both the Executive and the Legislature to collaborate in the management of the state economy for equitable and efficient allocation of resources.

He said that the power of the Assembly to approve budgets include the power to analyse, debate, amend and enact into law the estimates presented by the governor.

He said that the processes were designed to achieve a realistic distribution of resources and optimal opportunity for the people but regretted that though budgets had always been well conceived, implementation had remained a major challenge.

Kolawole therefore, urged all ministries departments and parastatals to be more alive to their responsibilities and avoid all tendencies that might impede the process of successful implementation of the budget.

He commanded the governor for some of the landmark projects being executed across the three Senatorial Districts of the state and particularly implored the governor to rehabilitate the Hassan Usman Katsina Road leading to the Assembly and the state High court among others.

He assured that the house would accord the 2022 Appropriation Bill a speedy passage to enable the government to commence in earnest, its implementation.

The News Agency of Nigeria (NAN) reports that Bello presented N130.5 billion for the 2021budget.

He said the budget is divided into the recurrent expenditure of N70.04 billion representing N56.72 percent and capital expenditure of N56.49 billion representing N43.28 percent.

He said that the total estimated recurrent revenue of the budget was N82.4 billion consisting of N20.9 billion which will be realized from internal sources, while N45.4 billion comes from the federation account.(NAN)