Gov. Godwin Obaseki of Edo on Thursday said that a well-developed capital market would catalyse economic growth and infrastructure development, as well as long-term investments.

Obaseki spoke at the hybrid 25th annual Stockbrokers Conference organised by the Chartered Institute of Stockbrokers (CIS) in Lagos.

The News Agency of Nigeria (NAN) reports that the ongoing two-day conference has the theme: “Capital Market as a Catalyst for Economic Development and Sustainable Growth”.

Obaseki cited the capital market as having a symbiotic relationship with the economy to serve as a key enabler for governments at all levels to access capital for infrastructure development.

Speaking on the infrastructural deficit in the country, the governor pointed out that Nigeria required in excess of N357 trillion over the next five years to fund its development.

He said that at least 70 per cent of this funding would have to come from the private sector, which meant that the capital market would be largely responsible for a large percentage of this.

Obaseki said that there was a nexus between the development of a country’s capital market and the economy as reflected in the percentage of market capitalisation to the Gross Domestic Product (GDP) of developed economies globally.

Commenting on the multiple exchange rates in the country, Obaseki cited continents like Europe, U.S. and Asia as having free capital movement and exchange rate stability.

He said that these had attracted more capital and development to their capital markets.

“In the U.S., the market capitalisation is 143 per cent of GDP, Canada has 124 per cent, Japan 92 per cent, but that cannot be said of Nigeria or most emerging countries.

“As you are aware, we need capital markets so we can attract long term development and achieve financing development, and the capital market can help the government to improve rapid development.

“Capital market is a significant contributor to our own economic development, and so for Nigeria to become part of the league of countries with strong economies, it must have a well developed capital market,” Obaseki said.

He noted that stockbrokers belonged to that segment that had a capacity to mobilise and allocate medium to long term capital for the country’s development, and the market was a catalyst for socio-economic development and sustainable growth.

Obaseki called for improvement regarding the ease of doing business to create more incentives for people to come and invest in the market.

He said there was the need to relax capital control measures and promote exchange rate uniformity.

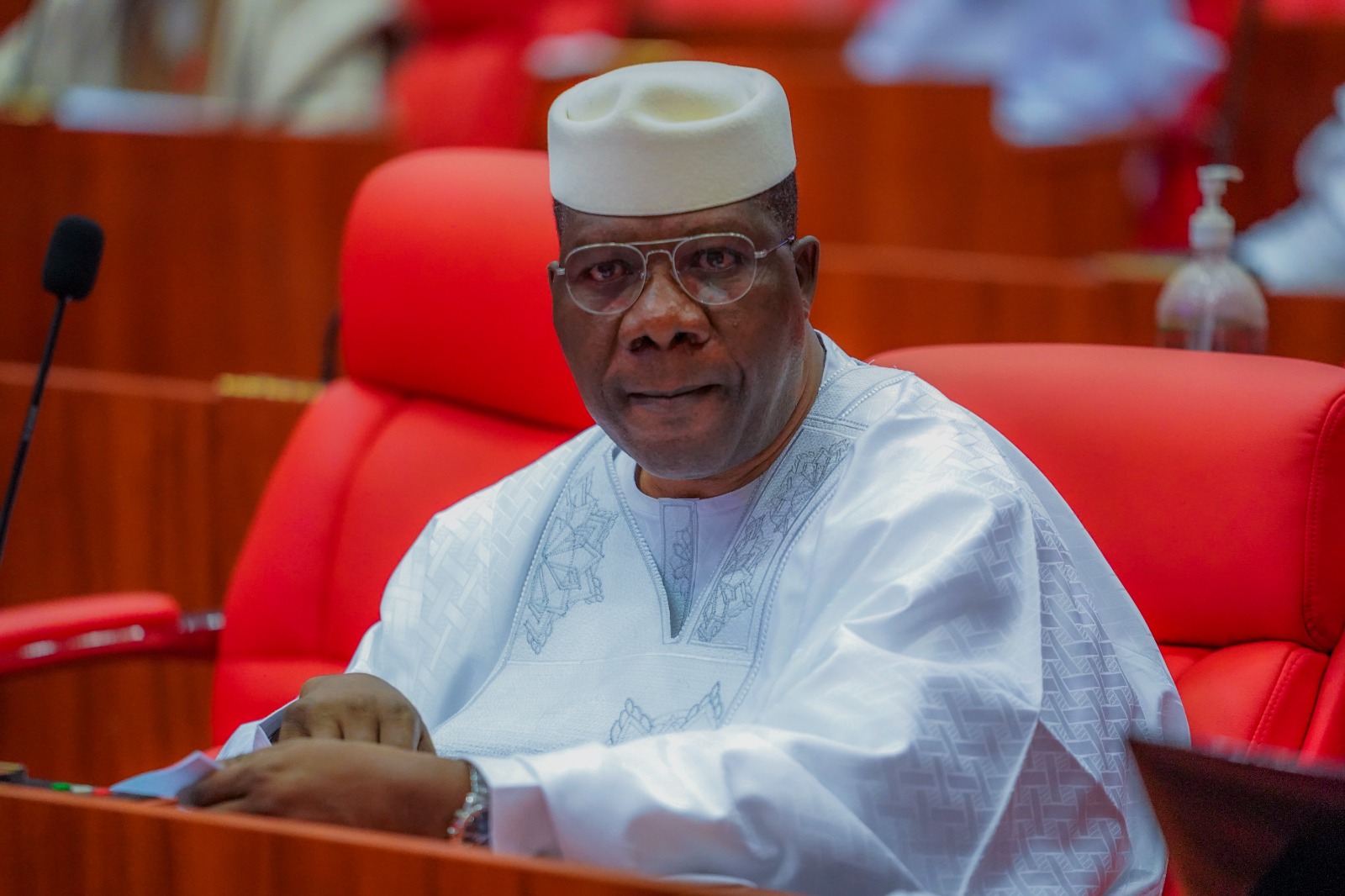

The Chairman, House Committee on capital market, Rep. Babangida Ibrahim, said the theme was timely, as it presented opportunities for stockbrokers to fashion out better ways to assist the government in revitalising the economy.

He said that the CIS conference had come at a time the parliament was embarking on the legislative activities in the passage of the 2022 appropriation bill submitted to the National Assembly by President Muhammadu Buhari.

The house committee chairman urged the stockbrokers to employ their professionalism in collaborating with the legislature in the process.

The Governor of Osun, Mr Gboyega Oyetola, represented by the Commissioner for Finance, Mr Bola Oyebamiji, said in his keynote address that the institute had played a critical role in revitalising the economy.

In his address of welcome, the President/Chairman of Council, Mr Olatunde Amolegbe, had said that activities such as national workshops and conferences were ultimately aimed at sustaining the institute’s advocacy role .

According to Amolegbe, this year’s conference delved deep into the area of macroeconomics on how government, corporate bodies and individual investors can harness investment opportunities through the capital market.

He noted that the Institute was on record as being one of the first organisations in Nigeria to embrace technology as its new way of life and was the first professional body to conduct a full-fledged computer-based examination diet.

The Group Chief Executive Officer, Nigerian Exchange (NGX) Group, Mr Oscar Onyema, said that there had been increased discussions around the capital market development, which was crucial to economic growth and sustainability.

NAN reports that the institute inducted 321 new Associates and 40 Fellows during the conference.

The CIS also pledged its continuous advocacy towards attracting more participants into the Nigerian capital market. (NAN)