President Bola Tinubu says Nigeria’s national defence and internal security, local job creation, macro-economic stability, investment environment optimization, human capital development, poverty reduction, and social security are some of the top priorities of the 2024 Budget of Renewed Hope.

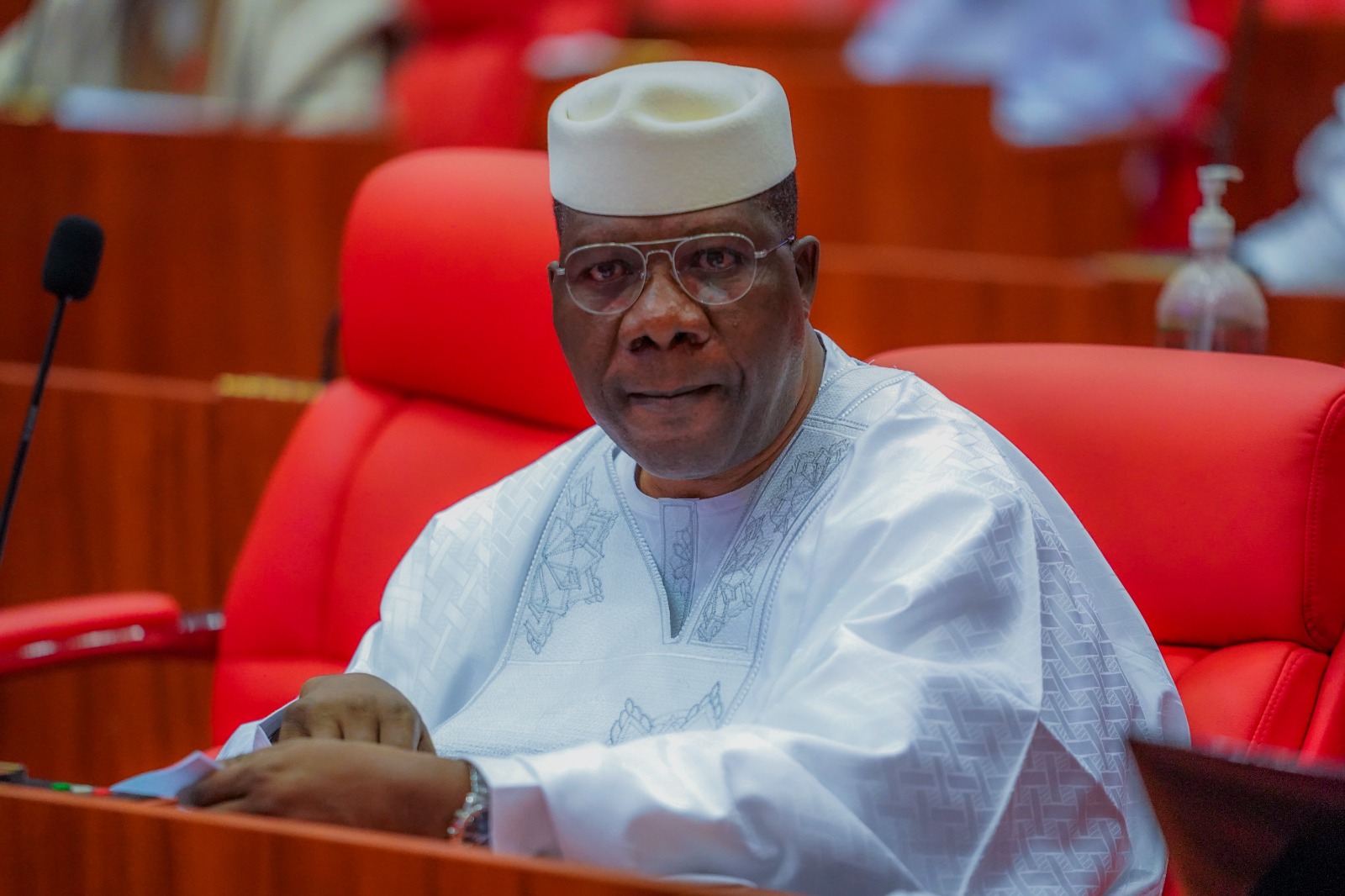

Addressing a joint session of the National Assembly on the 2024 Federal budget proposal on Wednesday in Abuja, President Tinubu said the nation’s internal security architecture will be overhauled to enhance law enforcement capabilities with a view to safeguarding lives, property, and investments across the country.

He said the proposed budget prioritizes human capital development, with particular attention given to children, because human capital remains the most critical resource for national development.

“To improve the effectiveness of our budget performance, the government will focus on ensuring value for money, greater transparency, and accountability. In this regard, we will work more closely with development partners and the private sector.

“To address long-standing issues in the education sector, a more sustainable model of funding tertiary education will be implemented, including the Student Loan Scheme scheduled to become operational by January 2024,” the President affirmed.

Speaking on the economy, President Tinubu said a stable macro-economic environment is crucial in his administration’s bid to catalyze private investment and accelerate economic growth; hence, his government shall continue to implement business and investment friendly measures for sustainable growth.

“We expect the economy to grow by a minimum of 3.76 percent, above the forecasted world average. Inflation is expected to moderate to 21.4 percent in 2024. In preparing the 2024 Budget, our primary objective has been to sustain our robust foundation for sustainable economic development. A critical focus of this budget and the medium-term expenditure framework is Nigeria’s commitment to a greener future.

“Emphasizing public-private partnerships, we have strategically made provisions to leverage private capital for big-ticket infrastructure projects in energy, transportation, and other sectors. This marks a critical step towards diversifying our energy mix, enhancing efficiency, and fostering the development of renewable energy sources. By allocating resources to support innovative and environmentally conscious initiatives, we aim to position Nigeria as a regional leader in the global movement towards clean and sustainable energy.

“As we approach the COP28 climate summit, a pivotal moment for global climate action, I have directed relevant government agencies to diligently work towards securing substantial funding commitments that will bolster Nigeria’s energy transition. It is imperative that we seize this opportunity to attract international partnerships and investments that align with our national goals. I call upon our representatives to engage proactively to showcase the strides we have made in the quest to create an enabling environment for sustainable energy projects.

“Together, we will strive for Nigeria to emerge from COP28 with tangible commitments, reinforcing our dedication to a future where energy is not only a catalyst for development but also a driver of environmental stewardship,” he said.

The President said a conservative oil price benchmark of 77.96 U.S. Dollars per barrel and a daily oil production estimate of 1.78 million barrels per day were adopted after a careful review of global oil market trends, and that a Naira to U.S. Dollar exchange rate of 750 naira per U.S. Dollar was adopted for 2024 as well.

Giving a breakdown of the 2024 Appropriation Bill, the President said: “Accordingly, an aggregate expenditure of 27.5 trillion naira is proposed for the Federal Government in 2024, of which the non-debt recurrent expenditure is 9.92 trillion naira while debt service is projected to be 8.25 trillion naira and capital expenditure is 8.7 trillion naira. Nigeria remains committed to meeting its debt obligations. Projected debt service is 45% of the expected total revenue.

“The budget deficit is projected at 9.18 trillion naira in 2024 or 3.88 percent of GDP. This is lower than the 13.78 trillion naira deficit recorded in 2023, which represented 6.11 percent of GDP. The deficit will be financed by new borrowings totaling 7.83 trillion naira, 298.49 billion naira from Privatization Proceeds, and 1.05 trillion naira draw down on multilateral and bilateral loans secured for specific development projects.”

President Tinubu said his administration remains committed to broad-based and shared economic prosperity, adding: “We are reviewing social investment programmes to enhance their implementation and effectiveness. In particular, the National Social Safety Net project will be expanded to provide targeted cash transfers to poor and vulnerable households.”

He also said efforts will be made to further contain financial leakages through the effective implementation of key public financial management reforms.

The President commended the patriotic resolve of the 10th National Assembly to collaborate with the Executive on the mission to renew the hope of Nigerians and deliver on the promises made to Africa’s largest population.

“As you consider the 2024 Budget estimates, we trust that the legislative review process will be conducted with a view to sustaining our desired return to a predictable January-December fiscal year. I have no doubt that you will be guided by the interest of all Nigerians. We must ensure that only projects and programs with equitable benefits are allowed into the 2024 Budget. Additionally, only projects and programs that are in line with the sectoral mandates of MDAs and those which are capable of realizing the vision of our administration should be included in the budget,” the President declared.