The Oil and Gas Free Trade Zones Authority (OGFZA), said it attracted the sum of $21.6bn foreign direct investment into the Nigeria’s economy between 2001 and 2021

The Authority, also said it secured the sum of $19.97bn fresh investment commitment for Nigeria’s oil and gas free zones for the 2021 to 2025 fiscal periods.

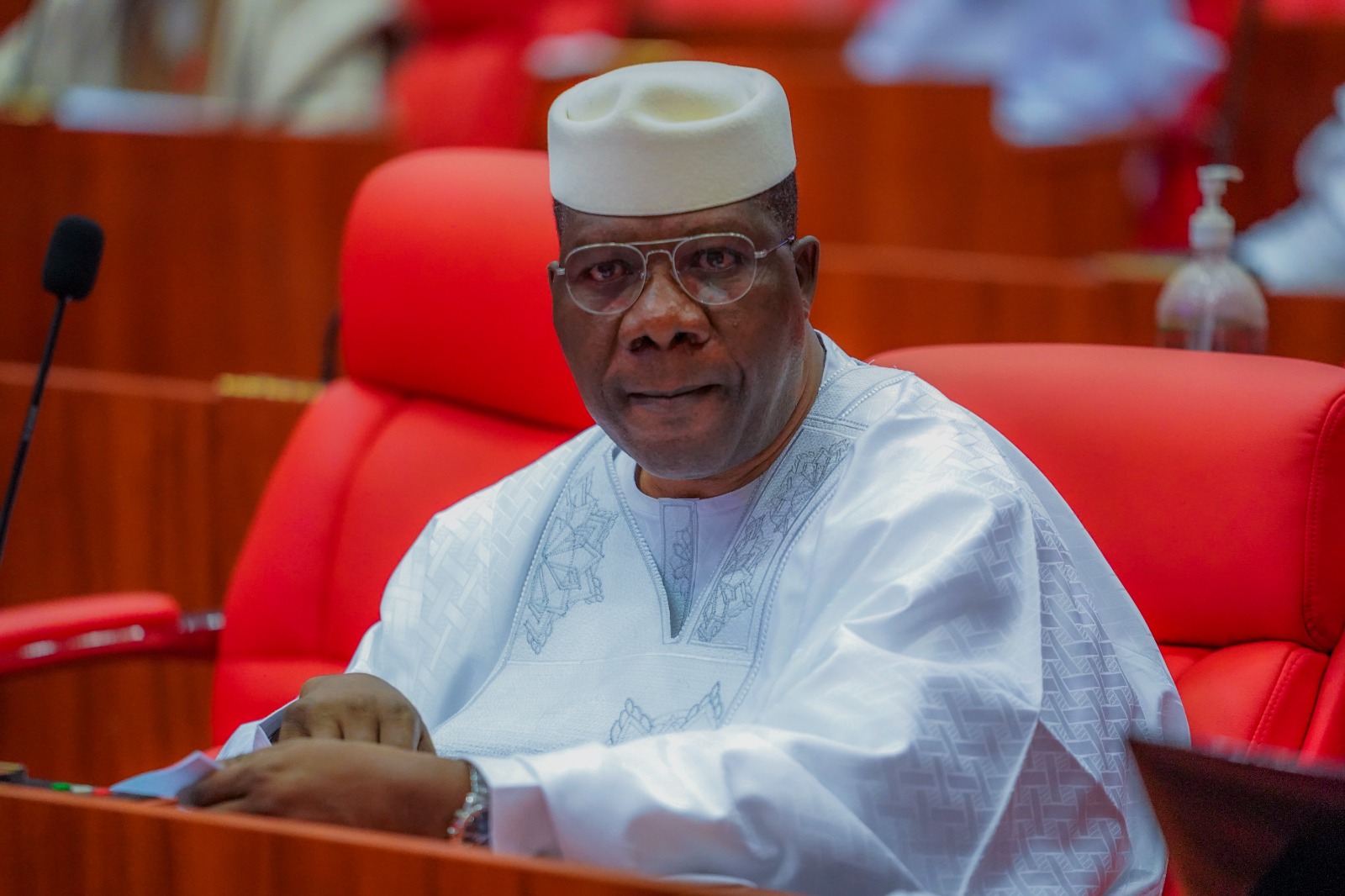

The Managing Director and Chief Executive Officer of OGFZA, Sen. Tijjani Kaura gave the figures during a chat with journalists in Abuja.

Sen. Kaura, said that the Oil and Gas Free Zones are evolving well and contributing significantly to the nation’s economy

He said, between 2021 and 2025 OGFZA has attracted a total investment commitment of $15.97b from new and existing investors in five of the Oil and Gas Free Zones.

Giving a breakdown of the investment commitments, Kaura put the proposed investment in Brass Oil and Gas Free Zone at $3bn; Notore Oil and Gas Free Zone $5.35bn; Liberty Oil and Gas Free Zone $6.4bn; Bestaf Maritime and Industrial OGFZ $485m and OGFZ-SBA Free Zone $738m

Accoding to him, “The Oil and Gas Free Zones Authority have recorded real achievements in quantitative terms which have contributed significantly to the nation’s GDP in the last two decades especially in three key indices namely Foreign direct investments (FDI) of $21.6b (2001-2021); technical skills transferred to Nigerians-35,330 (2001-2021); Number of Nigerians who have secured various levels of direct employment 41,085 persons and 164,000 indirect employments within the same period.

“In the area of revenue generation to Government, OGFZA activities accounted for the following revenues to the Federal Government between 2018 to 2021 Customs Duty of N119bn for goods exported from the Free Zones to Customs territory; Withholding Tax of N10.4bn for transactions carried out between Free Zone Enterprises and non-Free Zone licensees; and Value Added Tax (VAT) of N9.5bn for transactions carried out between Free Zone Enterprises and non-Free Zone licensees.”

Sen. Kaura, noted that the Authority has contributed to the reduction of Federal Government’s personnel and overhead costs by offering to become a partially self-funding Agency since January 2021, thereby saving the Federal Government over N2.3bn annually.

He said currently, OGFZA regulates eight Free Zones with six of them being fully operational, while processes towards the taking off of two are at various stages of completion.

He explained further that the agency has been achieving the objectives of government as revealed in the outcome of the evaluation exercise carried out by a high-powered Technical Committee set up in 2021 by the Federal Ministry of Industry, Trade, and Investment for the evaluation of the performance of Free Zone Licensees in Nigeria.

In that Report, he noted that OGFZA in the area of Employment scored 69% in achieving its expected employment generation targets while on skills transfer, it achieved 73% of the national goal for Free Zones.

He said in line with the determination of President Bola Ahmed Tinubu to bring a turnaround to Nigeria’s oil and gas sector, OGFZA has established Oil and Gas Free Zones in the resource-rich areas of Akwa Ibom State, Rivers, Bayelsa and Delta States respectively.

“In these states, the Authority has attracted gas processing projects eg (i) the Giwa Gas Project being constructed in the Liberty Oil and Gas Free Zone, Akwa Ibom State, (ii) the proposed methanol plant project at Brass Oil and Gas Free Zone, (ii) the Meliora Methanol FZE Project at Onne Oil and Gas Free Zone etc.

“The Authority is also working with E & P Companies (Exploration and Production) including Waltersmith Petroman Oil Ltd for the development of an Industrial and Innovation Park/Oil and Gas Free Zone in Imo State and similar projects, which will operate as clusters for downstream gas-to-industry manufacturing and related activities,” he added.

In the area of midstream activities, Kaura said the Authority has commenced discussions with key industry stakeholders like BrentexCPP Limited, a consortium of Brentex Petroleum Services Ltd/China Petroleum Pipeline Engineering Co Ltd (CPP), one of the contractors executing the project to support and facilitate the completion of the Ajaokuta-Kaduna-Kano (AKK) Gas pipeline project through its trade facilitation incentives.