The Minister of Finance, Budget and National Planning, Dr Zainab Ahmed, says the Nigerian capital market is a credible platform for medium to long term finance for economic development.

Ahmed said this at a webinar organised by the Securities and Exchange Commission (SEC) in collaboration with the Ministry of Solid Minerals Development on Thursday.

The minister added that the nation’s capital market was a key catalyst for the development of the critical sectors of the economy.

The theme of the webinar was: “Financing the Solid Minerals Sector through the Capital Market and the Critical Role of Commodity Exchanges.”

Ahmed said the facilitation of funding and provision of structured market platforms such as the commodities exchanges portends significant addition for the mining and solid minerals sector.

She said the event and its theme were relevant to the economy given the need to diversify and grow the economy, and to enable the nation achieve sustainable development in the post COVID-19 pandemic era.

“The mining sector is strategically based as alternative source for revenue generation in the economic diversification plan of the Federal Government of Nigeria.

“It also has the potential to create employment and develop rural settings for other benefits,” she said.

Ahmed noted that the mineral export guidelines by the Federal Government was formulated to address the need to keep accurate mineral trade data.

She said it was also to ensure effective monitoring of the evacuation of export proceeds, to optimise the collection of royalties, and facilitate the implementation of free shipment inspection policies.

She explained that the initiative of employing the commodities exchange in this regard would encourage responsibility accounting and fairness to governance.

The minister assured of the unwavering support of the Federal Ministry of Finance, Budget and National Planning to ensure the achievement of the overarching objective of the Federal Government to develop the mineral potential of the country.

“The reality is that the nation stands to benefit more in an organised mining and solid mineral extractive industry and the capital market is here to contribute its quota.

“This webinar is a signal that with the appropriate collaboration amongst sectors, institutions, regulators and operators, we can exceed out targets sooner rather than later and Nigeria will reap huge benefits from such forums,” she added.

In a welcome address, SEC’s Director-General, Mr Lamido Yuguda, said with over 44 minerals found across the federation, the solid minerals sector would be instrumental in the on-going quest to diversify the economy.

Yuguda said: “We believe that the Nigerian commodity trading system and indeed the capital market can be the transformational patronage to bring about this positive changes in the sector.

“With opportunities provided for better access to marketing of produce, price discovery and valuable market information, a striving commodities trading ecosystem has the potential to foster inclusive mining prosperity.

“It will also enhance financial inclusion of artisanal miners, foster mineral production, stimulate exports and ultimately engendered economic development, amongst other benefits.

“Undoubtedly, greater connectivity of the mining sector and the commodities trading ecosystem will ensure that mineral commodities could be traded on transparent, efficient and organised trading platform provided by commodity exchanges.”

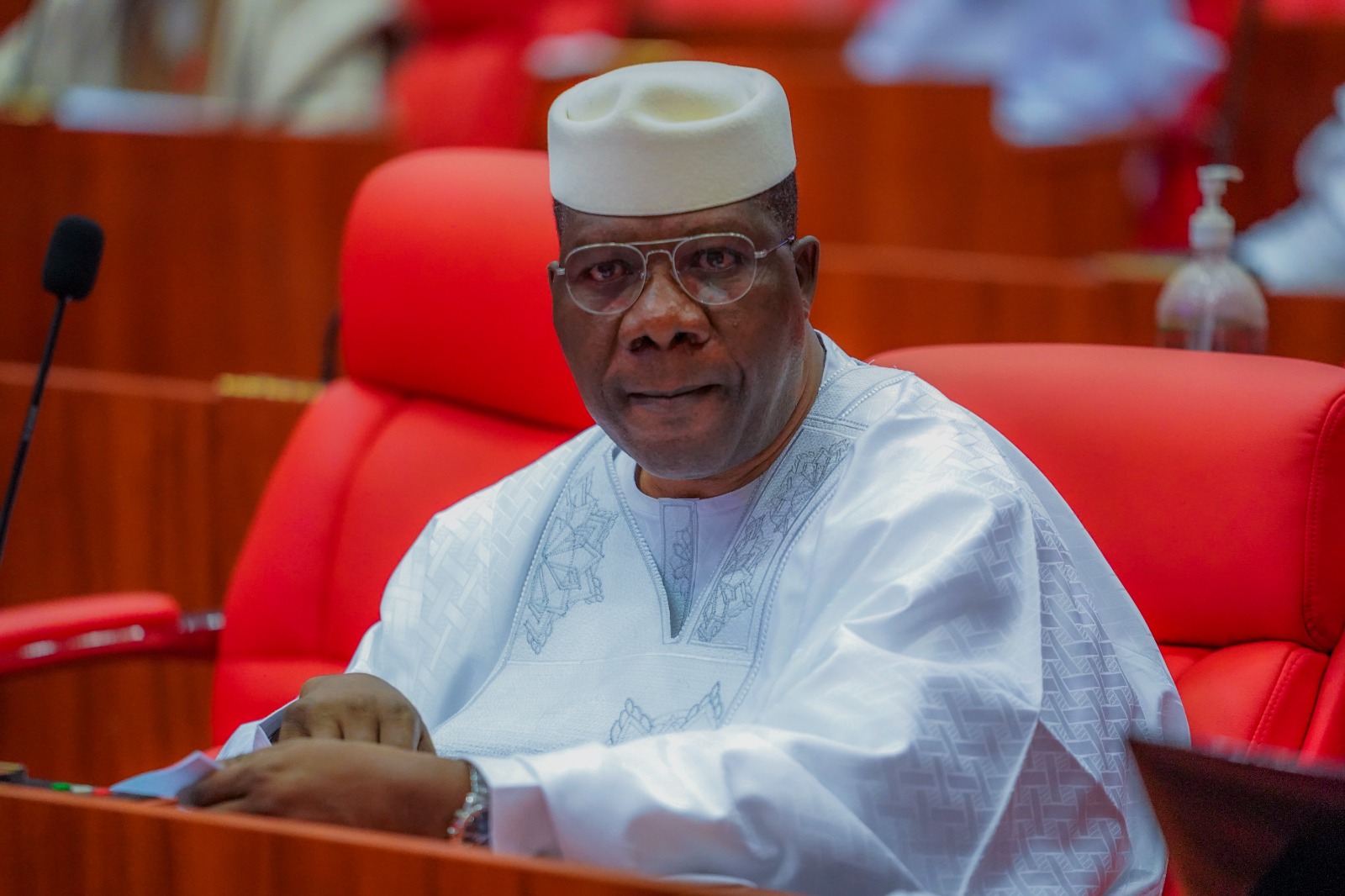

In his keynote address, Minister of State, Ministry of Solid Minerals and Steel Development, Dr Uchechukwu Ogah, described the webinar as timely because it came at a time that President Muhammadu Buhari, had put all the necessary machinery in place to revamp the sector for economic stability.

Oga, however, expressed disappointment that over 90 per cent of the artisanal miners and small scale operators’ contribution to employment was still very low with a Gross Domestic Production (GDP) contribution of 0.5 per cent.

“We eagerly want to change this through implementation of the roadmap to contribute about five per cent to the GDP by 2025.

“Inadequate funding has been the bane of underdevelopment; it is on this premise that I welcome this partnership with the SEC,” he said. (NAN)