The French Government has agreed to collaborate with the Federal Government to develop inland dry ports in the country.

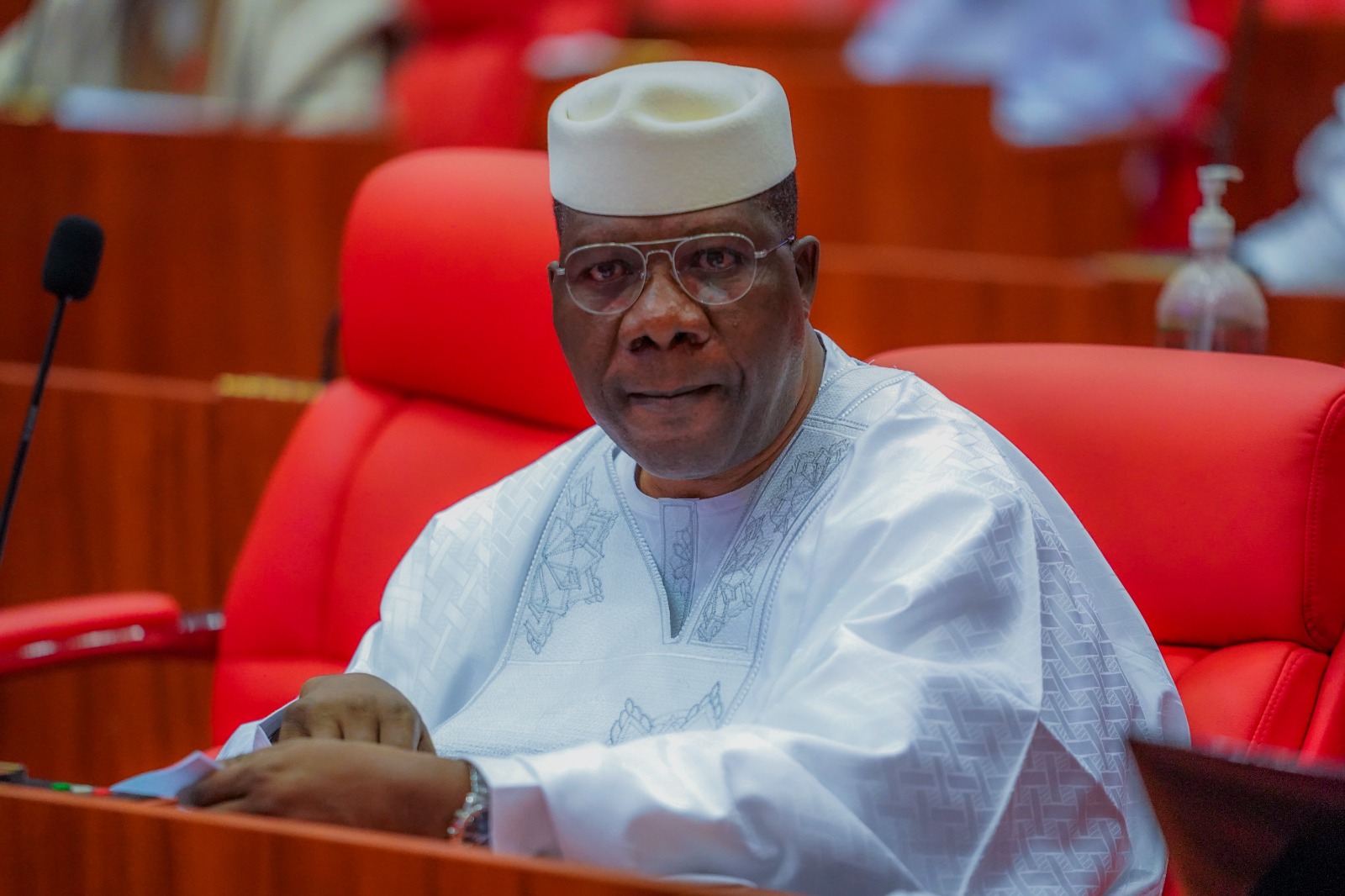

Mr Hassan Bello, Executive Secretary/Chief Executive Officer, Nigerian Shippers’ Council (NSC), disclosed this during a collaborative meeting between the duo and investors delegation on Thursday in Abuja.

The News Agency of Nigeria (NAN) reports that the thrust of the meeting was the development of inland dry ports, rail transportation infrastructure, export and import promotion and development between both countries.

Bello explained that after due study, five locations were chosen by the Federal Government for the construction of a dry port and they were, Funtua, Kano, Ibadan, Plateau and Isiala Ngwa in Abia.

According to him, the dry port at Funtua is already 68 per cent completed and with efforts by the Nigerian Railway Corporation (NRC) it can be ready for operations in October or November.

He noted that reasonable progress had also been made in the other various ports, adding that the critical issue was that the projects were concessioned to the private sector.

“The Federal Government thinks that in order to bring shipping closer to the people there should be ports.

“The guidelines for the policy is that dry port will decongest the sea port, it will make things easier for everybody, secondly we have to galvanise export.

“Nigeria cannot be import dependent country for a long time, we need to export to earn all the foreign currency. It is intended that the dry port will be centred for export.

“In which case we are going to bring standards. Pre-export inspectors so that once you are exporting, it is certified, everything is sealed and taken by rail mostly to the ship that is waiting and off it goes.

“What it does is that you are spreading the economy and giving exporters access to the ports. We are calling for government to declare the dry port as centres for exports so everything will be there.

“There will also be free zones, so most of the taxes will be lessened. We want to make these ports very comprehensive, we have to add value, we must have the compliment of the cold storage as to really cure these post-harvest losses.

“The most important thing is that we need to enhance and open the ports for local and international investments,’’ Bello said.

On railway, the NSC boss, said rail capacity was key to the success of the dry ports, adding that to earn the confidence of investors, we should have scheduled railway services.

He noted that some countries had indicated interests to invest, therefore, it was important to get things right.

According to him, the idea is not just to have a port, but to have a modern/electronic port that is in accordance and compliance with the ISPS code and of international standard.

He thanked the Managing Director, NRC, Fidet Okhiria, for accepting to ensure availability of land for investors to create additional values.

He, however, urged him to take a critical independent survey of all the ports and lay it before the Federal Government so that rail shouldn’t be a cause for delay of the port.

He also appealed that the ports shouldn’t be allowed to be congested like the Apapa ports, goods be cleared 24 hours, no demurrage or rent seeking and the ports must relate to the economy and the community.

Representing the French government, its Regional Agriculture Counsellor, Dr Sonia Darracq, expressed readiness of its government to collaborate with Nigeria.

While reiterating the importance of the dry port, Darracq, said it would amongst other things, boost the agricultural sector of the country, as it would curb post-harvest losses of food products.

“I am in contact with some French companies that will be interested in partnering in the development of the dry port be it for food or other things.

“And I brought in some documentation for companies that also cover the cold chain sector and they will be very much willing to know better about your policy in terms of dry-port development in order to investigate some ways of cooperation.

“I am here to understand better, what the government and private sector plan in developing the dry port sector and all other infrastructure.

“I am mostly concerned with the transportation of our food but I’m also very keen to know the strategy of development of the highway, the roads.

“I came here specifically at the request of the number one in France in the cold chain. This is a group of French companies which deals in cold chain for more than 50 years.

“They have a vast experience, they are private companies and are very much willing to start business discussions with you.

“I am a government person and the French government is very much willing to assist in the form of some financial tools we can activate for the beginning.

“We want to be part of the transformation of all or few environmentally friendly energy sources for all activities including the cold chain transportation and everything.

“To that we can easily activate not only the French financial assistance but also the European Union.

“ I will write a report that I will share with my ambassador but also with the EU representatives here because I think this is for us, a golden opportunity to work together and to be part of this development that is critical for the country,’’she added.

The Managing Director, NRC in his remark, reiterated the importance of rail in industrialisation and development.

Okhiria reiterated efforts of President Muhammadu Buhari’s administration to link the country through rail, stating that work was on going to revitalise/construct the narrow and standard gauge lines in the country.

He said :“ the Federal Government has taken the bull by the horns to develop the infrastructure and the dry ports now have rail tracks to move products.

“If we succeed in linking the rails, we will not only reduce congestion but encourage people to use other ports and boost the economy in the long run.

“I pray the government continues to have the will to develop the sector as it is not a cheap project.’’ (NAN)