The Presidency says a total of 15 projects, spread across the six geo-political zones of the country, are to be financed with more than $4 billion from multilateral institutions.

The loan is under the 2018-2021 medium term (rolling) external borrowing plan.

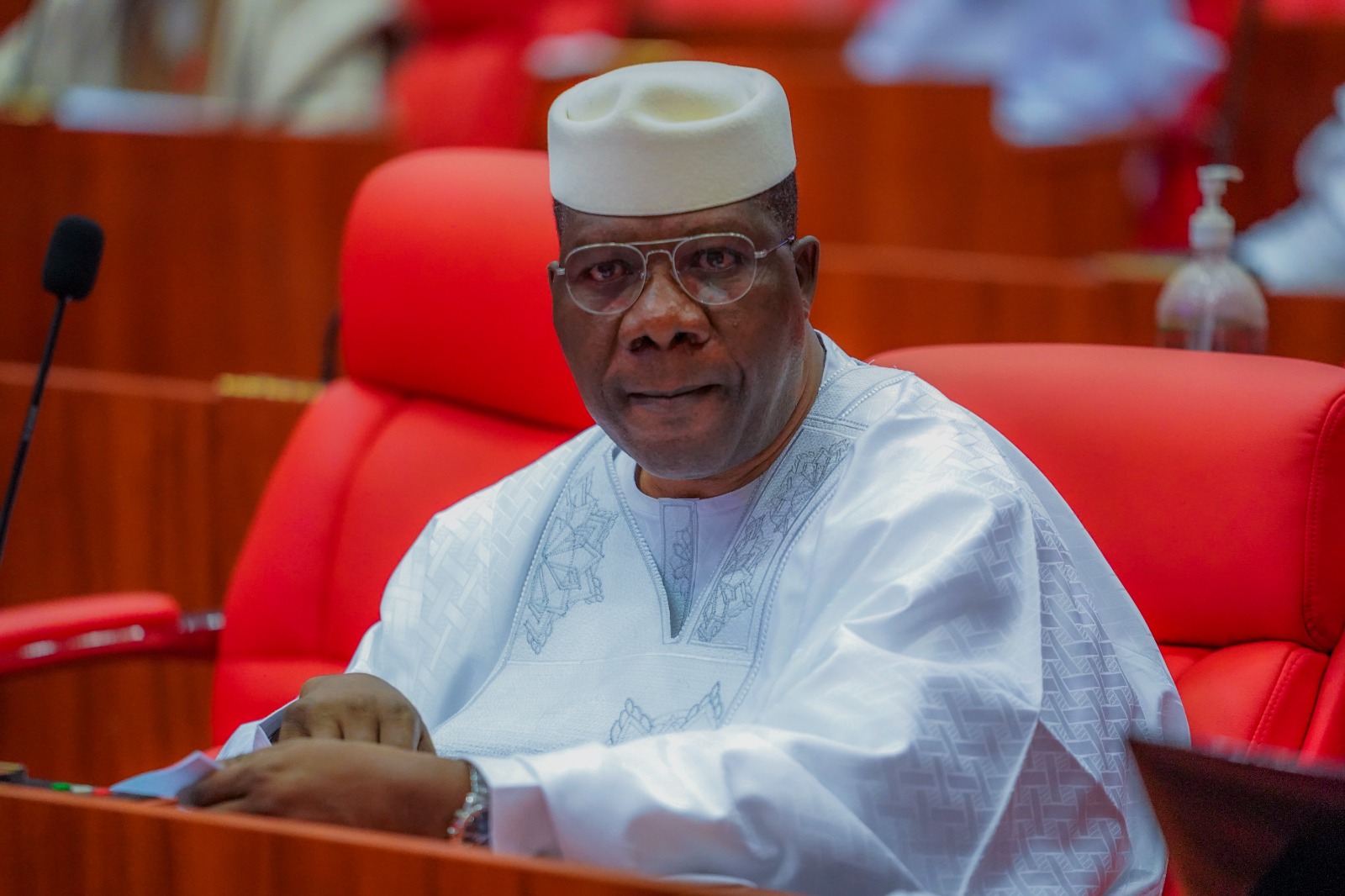

Malam Garba Shehu, Senior Special Assistant to the President on Media and Publicity, stated this on Saturday in Abuja.

He revealed that President Muhammadu Buhari had already requested the Senate to approve sovereign loans of $4.054billion and €710million as well as grant components of $125million for the proposed projects.

He quoted the letter by the president as saying that the sovereign loans will be sourced from the World Bank, French Development Agency (AFD), China-Exim Bank, International Fund for Agricultural Development (IFAD), Credit Suisse Group and Standard Chartered/China Export and Credit (SINOSURE).

He said: “The President’s request to the Senate listed 15 proposed pipeline projects, the objectives, the implementation period, benefiting states, as well as the implementing Ministries, Departments and Agencies (MDAs).

“A breakdown of the Addendum to the Proposed Pipeline Projects for the 2018-2021 Medium Term (rolling) External Borrowing Plan shows that the World Bank is expected to finance seven projects including the $125million grant for ‘Better Education Services for All’.’’

According to him, the Global Partnership for Education grant is expected to increase equitable access for out-of-school children and improve literacy in focus states.

He expressed the hope that the grant, which would be implemented by the Federal Ministry of Education and the Universal Basic Education Commission (UBEC), would strengthen accountability for results in basic Education in Katsina, Oyo and Adamawa States.

Other projects to be financed by the World Bank, according to Shehu, are the State Fiscal, Transparency, Accountability and Sustainability Programme for Results as well as the Agro-Processing, Productivity, Enhancement and Livelihood Improvement Support Project.

He said the benefiting states for the agro-processing project included, Kogi, Kaduna, Kano, Cross River, Enugu and Lagos with the Federal Ministry of Agriculture and Rural Development as the implementing ministry.

The presidential aide stated that the objective of the project was to enhance agricultural productivity of small and medium scale farmers and improve value addition along priority value chains in the participating states.

Shehu added that the World Bank would also be financing the Nigeria Sustainable Water Supply, Sanitation and Hygiene (WASH) project in Delta, Ekiti, Gombe, Kaduna, Katsina, Imo and Plateau States, for the next five years.

According to him, the project, when completed, is expected to improve rural water supply, sanitation and hygiene nationwide towards achieving Sustainable Development Goals (SDGs) for water supply and sanitation by 2030.

“Under the external borrowing plan, the World Bank supported projects also include Nigeria’s COVID-19 Preparedness and Response Project (COPREP), under the supervision of the Federal Ministry of Health and Nigeria Centre for Disease Control (NCDC).

“The project, which has an implementation period of five years, will respond to threats posed by COVID-19 through the procurement of vaccines.

“Furthermore, no fewer than 29 states are listed as beneficiaries of the Agro-Climatic Resilience in Arid Zone Landscape project, which is expected to reduce natural resource management conflicts in dry and semi-arid ecosystems in Nigeria,’’ he said.

He gave the names of the benefiting states for the project to be co-financed by World Bank and European Investment Bank (EIB) to include: Akwa Ibom, Borno, Oyo, Sokoto, Kano, Katsina, Edo, Plateau, Abia and Nasarawa.

Others are; Delta, Niger, Gombe, Imo, Enugu, Kogi, Anambra, Niger, Ebonyi, Cross River, Ondo, Kaduna, Kebbi, Jigawa, Bauchi, Ekiti, Ogun, Benue, Yobe and Kwara.

He said the World Bank would also be funding the Livestock Productivity and Resilience project in no fewer than 19 states and the Federal Capital Territory (FCT) while the China EXIM Bank is expected to finance the construction of the branch line of Apapa-TinCan Island Port, under the Lagos-Ibadan Railway modernisation project.

Shehu said: “The French Development Agency will finance two projects, which include the National Digital Identity Management project and the Kaduna Bus Rapid Transport Project.

“The digital identity project will be co- financed with World Bank and EIB.

“The Value Chain Development Programme to be financed by IFAD and implemented in Anambra, Benue, Ebonyi, Niger, Ogun, Taraba, Nasarawa, Enugu and Kogi States will empower 100,000 farmers, including over 6,000 and 3,000 processors and traders, respectively.

“The loan facility to be provided by European ECA/KfW/IPEX/APC will be spent on the construction of the Standard Gauge Rail (SGR) linking Nigeria with Niger Republic from Kano-Katsina-Daura-Jibiya-Maradi with branch to Dutse.

“The specific project title, Kano-Maradi SGR with a branch to Dutse, has an implementation period of 30 months and will be implemented by the Federal Ministry of Transport.

“The Chinese African Development Fund through the Bank of China is expected to provide a loan facility of $325 million for the establishment of three power and renewable energy projects including solar cells production facility Phase 1 & II, electric power transformer production, Plants 1, II, III and high voltage testing laboratory.

“The National Agency for Science and Engineering Infrastructure (NASENI) will implement the project aimed at increasing local capacity and capability in the development of power and renewable energy technologies and infrastructure,’’ he further disclosed.

Shehu revealed that the Credit Suisse would finance major industrialisation projects as well as micro, small and medium enterprises schemes to be executed by the Bank of Industry.

He said the SINOSURE and Standard Chartered Bank would also provide funds for the provision of 17MW Hybrid Solar Power infrastructure for the National Assembly (NASS) complex.

“The project, with an implementation period of five years, is expected to address NASS power supply deficit and reduce higher overhead burdensome cost of running and maintaining fossil fuel generators (25MW installed capacity) to power the assembly complex,’’ he added. (NAN)