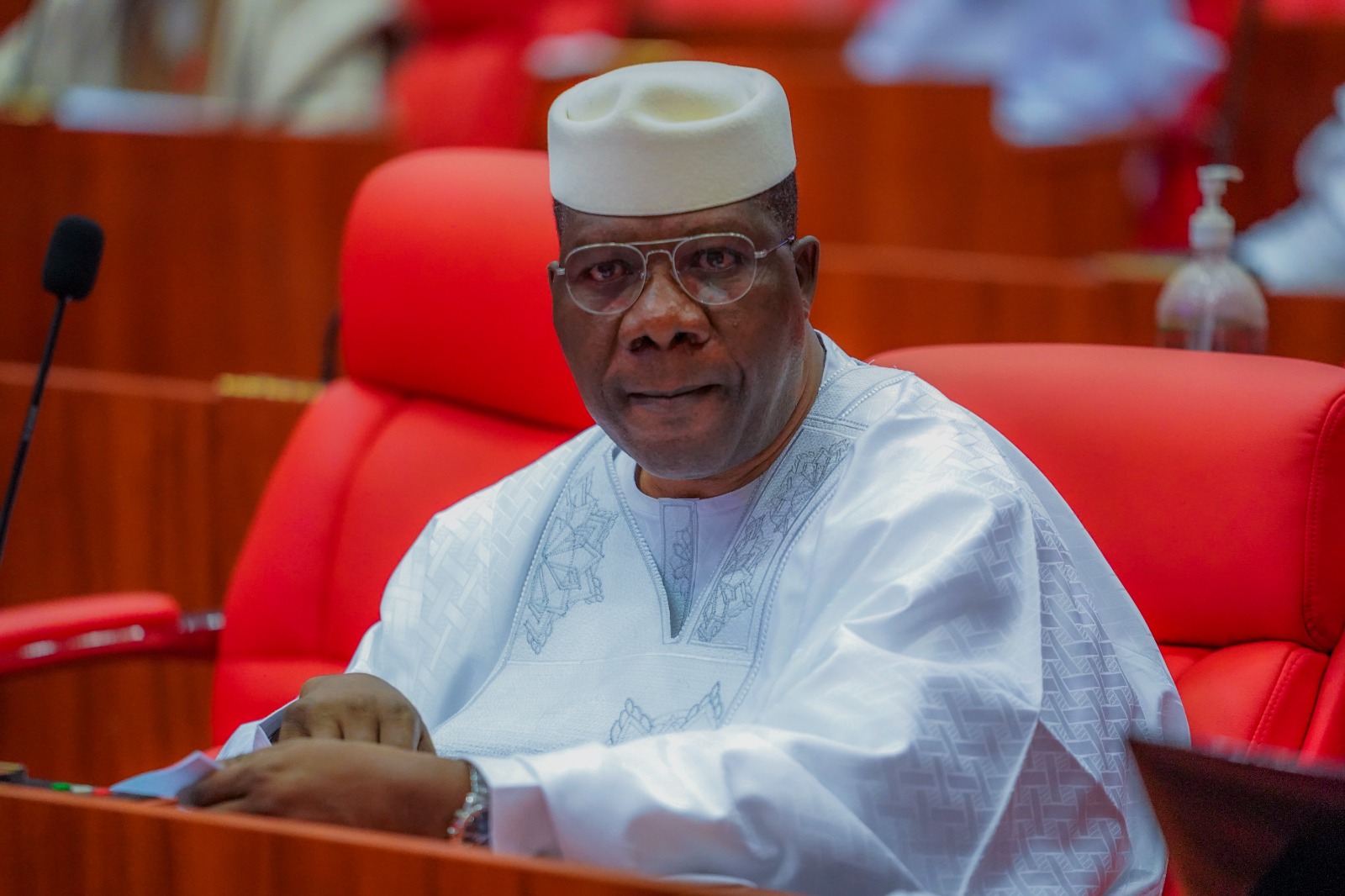

Senate President Ahmad Lawan, on Monday, said that revenue generating agencies of government are capable of generating and remitting N3 trillion naira annually to the coffers of the federal government if efforts are made to cut down on wasteful spendings.

Lawan made this known in an address delivered to declare open an interactive session “on the need to improve internally generated revenue of the Federal Government of Nigeria and Revenue Projections of the Agencies as Contained In the Appropriation Act 2020.”

The meeting was between the Senate Leadership and Members of the Committee on Finance and Revenue Generating Agencies of Government.

The Senate President, in his speech, said the purpose of the meeting was to explore means of increasing government revenues.

According to him, one of such ways was for the National Assembly to be rigid on increased revenue to cut down on the country’s budget deficit and borrowings, as well as prevent wasteful expenditures by agencies of government.

He assured that the upper chamber would provide the needed support through legislation to ensure that revenue agencies perform to meet and surpass their targets.

He said, “In 2022, the National Assembly assumed and rightly so, that our government owned enterprises can generate up to N3 trillion if we are of the mindset that we can achieve that and, of course, ensure that we oversight to stall any possibility of unwarranted expenditures by agencies of government.

“But that does not mean in any way that it is going to be some kind of investigation on what you do, but an encouragement of what you need to do.

See also Alleged N375.8 million Vehicle Purchase: NILDS tackles AGF, Says difference arose from price variation due to change in model of vehicle

“In this meeting and subsequent ones, there should be no holds barred on discussions.

“Where an agency feels it is encumbered in any way from achieving its target, it should say so, so that we are able to prescribe the right solutions for it to perform.

“As a National Assembly, let me say that the Senate particularly will be stiff on generating more and more revenue.

“We will be rigid, we will continue to insist, because we believe that this is one sure and guaranteed way of reducing our deficit and borrowing.

Lawan explained that the drive by the upper chamber for more revenues to the coffers of government, would enhance the economy and facilitate infrastructural development.

“This Committee is modified, because the leaders of the Senate believe that we can do far better and we have seen signs when last year some of the agencies performed beyond expectation.

“So, it is an opportunity for us to save and enhance our economy and, of course, make Nigeria achieve more infrastructural development which is the goal of this administration and every Nigerian.

“We believe that when you (revenue agencies) generate the money, we (National Assembly) appropriate it.

“Prudence is of essence here, when we spend our money. And when we borrow, like the National Assembly has always tried to do, we borrow to treat specific projects and programmes of government”, the Senate President said.

Chairman of the Committee on Finance, Senator Solomon Olamilekan Adeola, in his welcome address, lamented that there was insufficient funds for the implementation of policies and projects captured in the 2022 budget of the federal government.

See also I don’t have authority to speak on when Senate ‘ll pass 2022 budget -Senator Jibrin Barau

He explained that the funds were derived partly from the revenue generated by the government owned enterprises and other independent revenues sources of the federal government.

According to the lawmaker, “there is an urgent need for all hands to be on deck on revenue generation for government, as well as prevent misuse and leakages of such revenue for frivolous purposes not sanctioned by the laws of the National Assembly.”

He advised that for government to reduce and eliminate deficit budgeting associated with the nation’s budget over the years, effort must be made to minimise borrowing to fund projects.

Revenue agencies present at the interactive session include: National Agency for Science and Engineering Infrastructure, the Federal Inland Revenue Service (FIRS), National Steel Raw Materials Exploration Agency, Nigerian Postal Service, Lagos University Teaching Hospital, and Nigeria Customs Service.

Others were the Nigeria Immigration Service, Nigeria Security and Civil Defence Corps, Nigeria Prisons Service, Maritime Academy of Nigeria, National Agency for Food and Drug Administration and Control (NAFDAC), and Abuja Geographic Information Systems (AGIS).

Also present were the Federal Capital Territory Administration, Energy Commission of Nigerians, Administrative Staff College of Nigeria, Nigerian Export Import Bank (NEXIM), Nigerian Ports Authority and the Nigerian College of Aviation Technology, Zaria.