.. presents free C.A.C certificates to small scale entrepreneurs

…as 5,000 beneficiaries receive soft loans

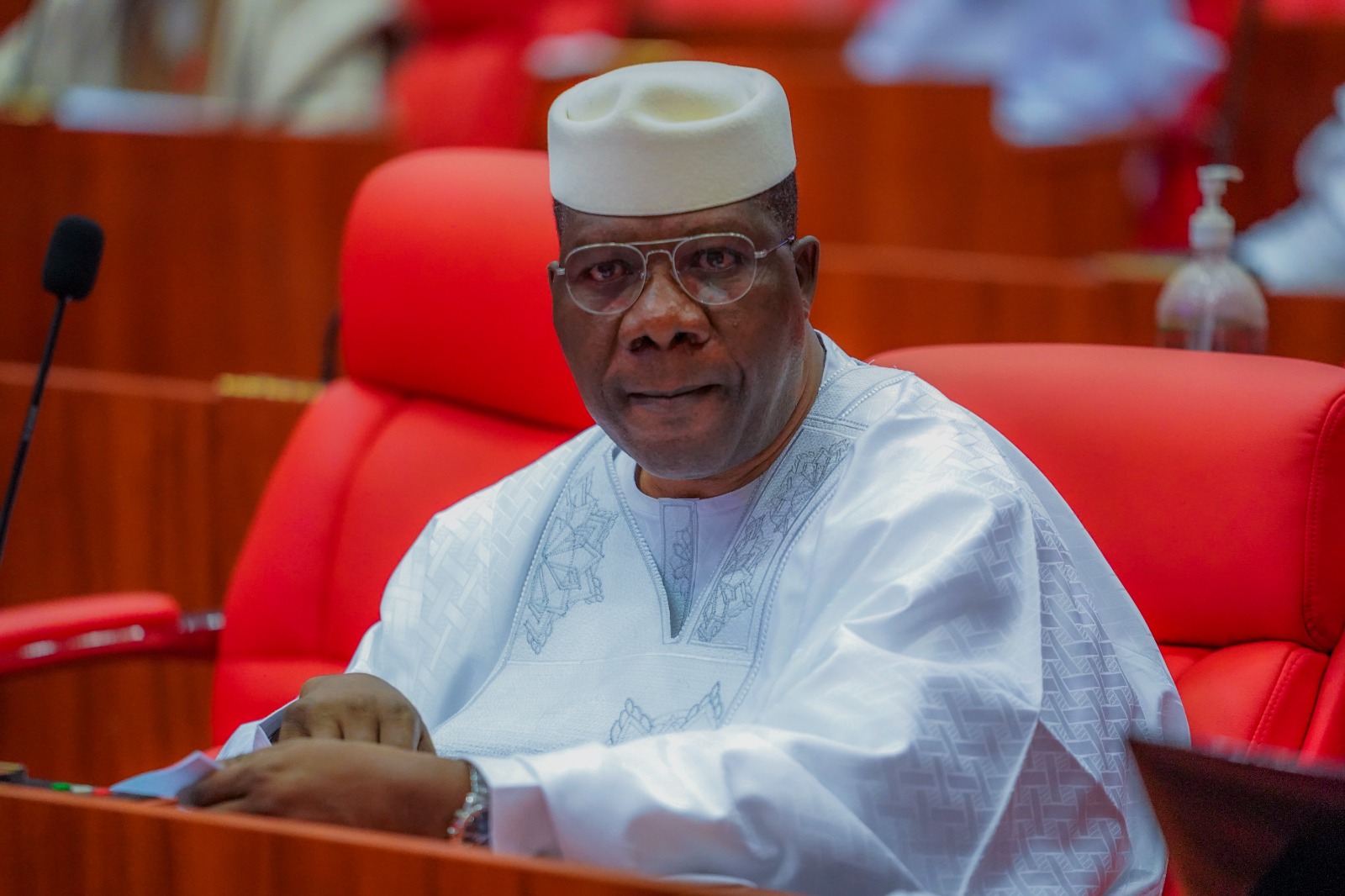

Osun Governor, Adegboyega Oyetola, on Wednesday flagged off the disbursement of N300,000,000 micro credit facilities to citizens in the State.

He said his administration would continue to making strenuous efforts to stimulate the state’s economy and create wealth for the benefit of the masses and incoming generations as contained in the government’s Development Agenda.

Oyetola said the noble economic initiative is in line with his resolve to place the state on a sustainable socioeconomic footing and steadily reduce the poverty rate and income inequalities among citizens.

This is even as over 5,000 micro and small scale entrepreneurs received soft loans ranging from N250,000 to N3million and over 6000 residents received certificates of incorporation having been freely registered by Corporate Affairs Commission (CAC).

The fund is part of the interventions of the Federal Government to the State through the Central Bank of Nigeria (CBN) aimed to raise the bar of socioeconomic activities in the State.

Recall that the government had in March last year granted N20,000 to 3,000 vulnerable Osun rural women across the 30 Local Government Areas and the funds were distributed in line with the equitable programmes and projects distribution model of the administration.

Speaking at the Year 2022 Medium, Small and Micro Enterprises Development Fund, held at Nelson Mandela Freedom Park, Osogbo, Governor Adegboyega Oyetola said the State had injected a whopping Two Billion, Three Hundred and Seventy Million, Nine Hundred and Ninety Five Naira (N2,370,995,000.00) into the economy of the State and that 4,646 micro and small scale entrepreneurs had benefitted across the State.

He disclosed that the State Government in collaboration with Osun Micro Credit Agency had disbursed the sum of One Hundred and Ninety Nine Million, Four Hundred and Twenty Thousand Naira (N199, 420, 000) to more than 1,000 beneficiaries since coming into office.

Governor Oyetola who was represented by his Deputy, Benedict Alabi, lauded President Muhammadu Buhari and CBN management for emplacing a policy that makes the various agencies of the Federal Government to intervene in the needs of the people of Osun and the revitalization of the economy of the State in manifold areas, including the critical sectors such as security, mining, health, environment and infrastructure.

“As you are all aware, the welfare of the people is the priority of this administration. Today’s intervention by the Central Bank, an annual event since 2018, which is targeted at Medium, Small and Micro Enterprises, is a commendable step towards improving the individual prosperity of our people and further stimulating the economic revolution being undertaken by our administration.

“I thank the CBN for believing in our administration’s transparency tendency in handling the previous disbursements of MSMEDF in the State, which has motivated the nation’s leading bank to continue to release more fund interventions to the State.

“It is on record that frequent injection of small business support funds by our Administration into the economy of the State has had significant impacts on the macro economic variables of the State.

“Our Administration is making strenuous efforts to stimulate the state’s economy and create wealth for the benefit of the masses and incoming generations. This noble economic policy of the State is steadily reducing the poverty rate and income inequalities among citizens.

“Credence to this fact is the injection of a whopping Two Billion, Three Hundred and Seventy Million, Nine Hundred and Ninety Five Naira (N2,370,995,000.00) only by the present administration to Four 4,646 beneficiaries across the State as MSMEDF by the Central Bank of Nigeria.

“This year, the Central Bank of Nigeria released the sum of Three Hundred Million Naira(N300,000,000.00) only to Osun State Government for disbursement as micro credit facilities to qualified Individuals, Small and Medium Enterprises as well as various cooperative societies engaged in viable economic activities both in formal and informal business organizations in the State.

“As usual, we shall weave transparent and open procedures around the distribution of the funds to enable qualified people and groups to have access to the fund.

“Consequently, we will not relent in consolidating the landmark achievements recorded so far in this direction as we, together, match to another political and governance dispensation this year”, Oyetola said.

Earlier, Commissioner for Commerce, Industries, Cooperatives and Empowerment, Dr. Bode Olaonipekun, commended Governor Oyetola’s resilience and commitment to redefining the economy of the State.

He said the initiative has recorded significant successes and helped to skyrocket the economy of the State as many of the beneficiaries had contributed tremendously to the improved socioeconomic status of Osun.

Olaonipekun who disclosed that over 6000 new micro, small and medium scale enterprises had been freely registered and certified by the Corporate Affairs Commission (CAC) said the initiative would go a long way to complement the government’s efforts at making soft loans available for the micro, small and medium scale entrepreneurs to start businesses.

In his remarks, the General Manager, Osun Micro Credit Agency, Mr. Sanya Olopade, applauded Governor Oyetola for taking the welfare and general well-being of the citizens as priority.

Olopade described the initiative of regular disbursement of soft loans to entrepreneurs as sine qua non to the collective quest of stimulating the state’s economy and placing it on a sustainable sure footing.

Expressing their profound gratitude to the government, some of the beneficiaries including, Mrs. Opeyemi Longe, Mrs. Ganiyat Ganiyu and Owo-Joy Oluwaseyi, promised to utilize the funds judiciously and for the purpose it was meant for.