The Central Bank of Nigeria (CBN) has lifted the ban placed on all 43 items previously restricted from purchasing Foreign Exchange to boost liquidity in the FX market.

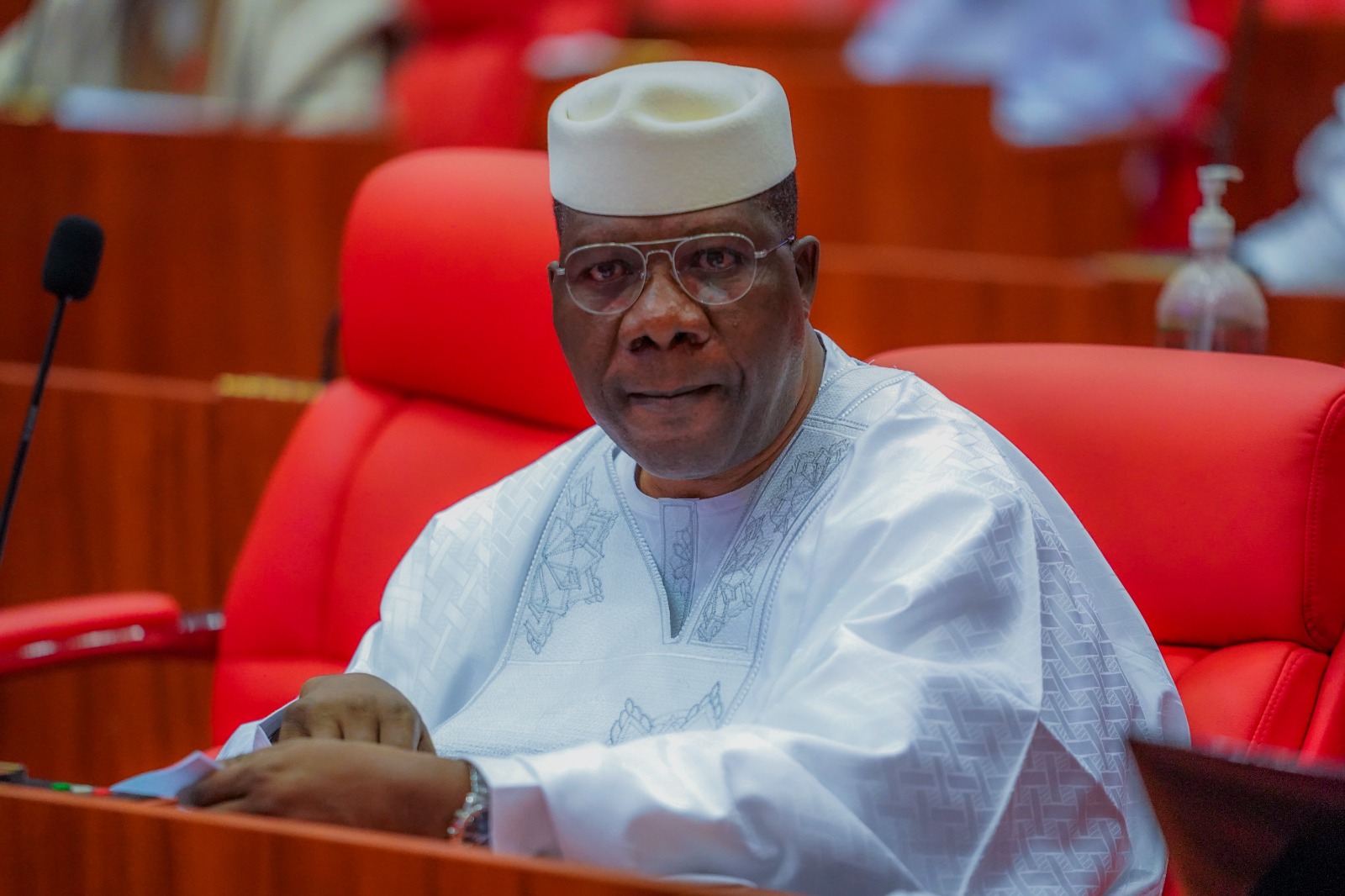

The CBN made this known in a statement issued by its Director, Corporate Communications, Dr Isa AbdulMumin, on Thursday, October 12, 2023.

The CBN had in October 2021 restricted access to Forex from FX market for the following 43 items: Rice, cement, Margarine, Palm kernel, palm oil products and vegetable oils, Meat and processed meat products and Vegetables and processed vegetable products.

Others are: Poultry and processed poultry products, Tinned fish in sauce (Geisha)/sardines, Cold rolled steel sheets, Galvanized steel sheets, Roofing sheets, Wheelbarrows, Head pans, Metal boxes and containers, Enamelware, Steel drums, Steel pipes, Wire rods (deformed and not deformed), Iron rods and reinforcing bars.

Also included on the list were: Wire mesh, Steel nails, Security and razor fencing and poles, Wood particle boards and panels, Wood fiberboards and panels, Plywood boards and panels, Wooden doors, Toothpicks, Glass and glassware, Kitchen utensils, Tableware, Tiles-vitrified and ceramic.

Textiles, Woven fabrics, Clothes, Plastic and rubber products, polypropylene granules, cellophane wrappers and bags, Soap and cosmetics, Tomatoes/tomato pastes, Eurobond/foreign currency bond/ share purchases, Piston crowns, Ball bearings, High voltage cables, Transformers/switch gears and Gas cylinders were also on list.

AbdulMumin noted that importers of all the 43 items previously restricted in 2015 are now allowed to purchase foreign exchange in the Nigerian FX market.

He said the apex bank would continue to promote orderliness and professional conduct by all participants in the market.

The CBN official stated that the move was to ensure that market forces determined exchange rates on a “Willing Buyer-Willing Seller” principle.

AbdulMumin noted: “The CBN reiterates that the prevailing FX rates should be referenced from platforms such as the CBN website, FMDQ, and other recognised or appointed trading systems.

“This is to promote price discovery, transparency, and credibility in the FX rates.”

He stated that as part of the CBN’s responsibility to ensure price stability, the apex bank would boost liquidity in the Nigerian FX market by interventions from time to time.

AbdulMumin added: “As market liquidity improves, these CBN interventions will gradually decrease.

“The CBN is committed to accelerating efforts to clear the FX backlog with existing participants and will continue dialogue with stakeholders to address the issue.

“The CBN has set as one of its goals the attainment of a single FX market. Consultation is ongoing with market participants to achieve this goal.”