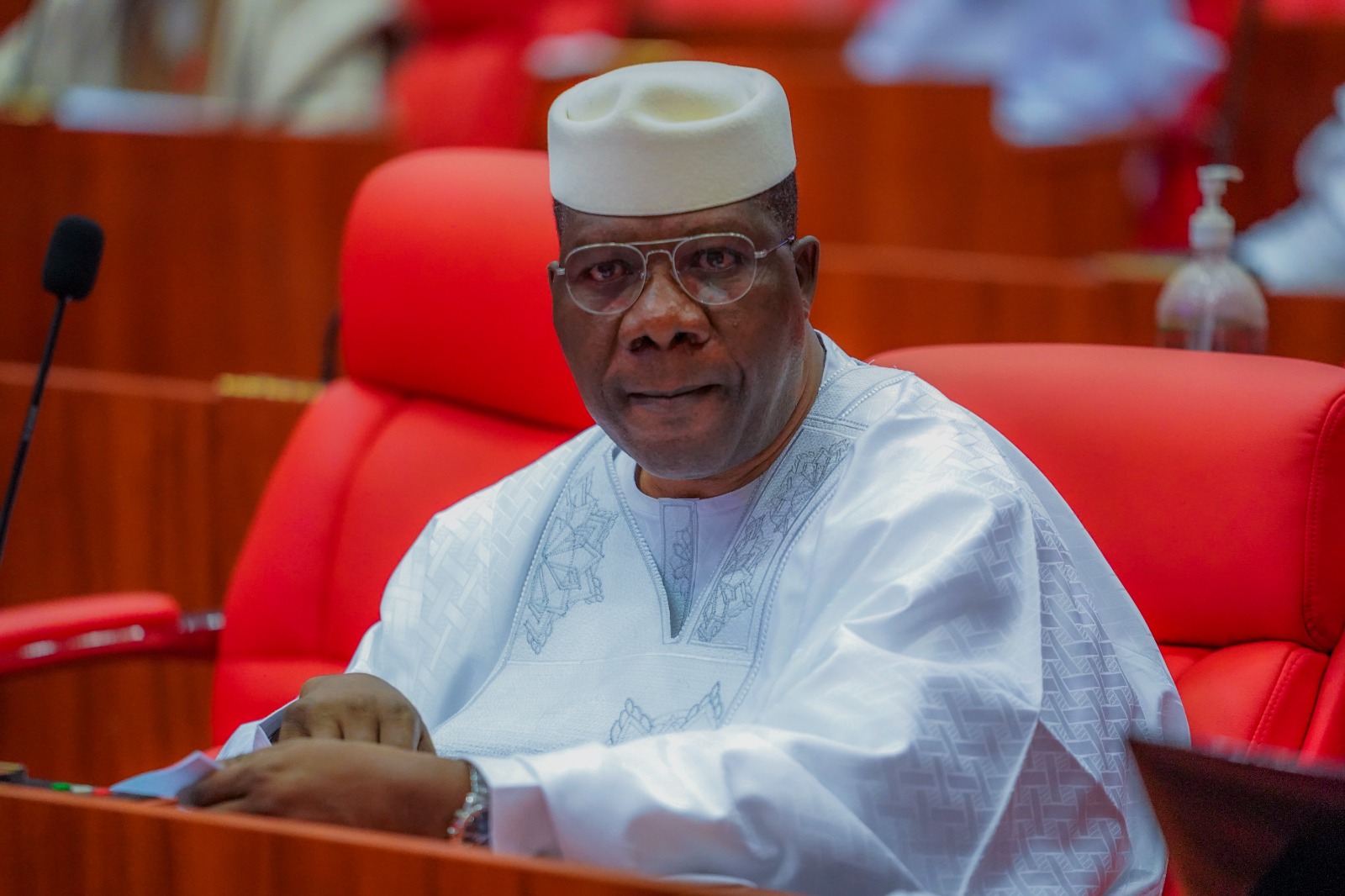

Godwin Emefiele, Governor of the Central Bank of Nigeria, (CBN), has said that the country is working on merging its exchange rate on the various markets.

Emefiele, said that the foreign exchange needed for the importation of petroleum products will decline by the end of this year when the Dangote Refinery commences operation.

Emefiele, was speaking on the sidelines at the ongoing World Bank/International Monetary Fund 2022 Spring Meetings in Washington DC, in reaction to the president of the World Bank, David Malpass, who had mentioned on Wednesday, at a press conference that, the multiple exchange rates in the country is not encouraging to investors and also not an effective way of managing the country’s exchange rate.

Emefiele, however said the CBN is working on a home grown solution at merging the exchange rates even as he emphasised the need to first merge the level of demand with that of supply.

He said: “What we do expect is that to develop a home grown solution that will lessen the situation.

“Nigeria is on a managed float and what that also means is that we cannot adopt what is being proposed that we go on a free float, doing that will create an exchange rate spiral for Nigeria as long as the demand surpass the supply of foreign exchange in Nigeria.

“With the Dangote Refinery coming up with the 650,000 barrels per day hopefully by around the end of the year. That will also start to also reduce the demand for foreign exchange that will normally will go for importation of petroleum products.

“I have often said between the importations of refined products alone, importation or whether it is rice or sugar or wheat, consumes close to about 40 per cent of foreign currency that is needed to fund imports in Nigeria. And if we find for instance, a situation were by around the end of this year, we’re able to begin to see we are no longer going to be needing foreign import petroleum products.

“We have been at this since 1986 and that is why we are saying that whereas, we are doing something to adjust the currency like for instance between 2015 and now, you would observe that we have adjusted the currency from about N155 to about N420 that it is today.

So, we cannot be accused of not adjusting the currency that we are trying to adopt a very gradual approach towards adjusting the price to the level that it is today but at the same time. We have to be given a chance to also look at while we are adjusting price, we must also do something about demand and supply.

“That is the reason we are saying that we need to do something on demand to make sure that those things that we can produce in the country we restrict access to foreign exchange for them so, that that will encourage people to produce locally.

When that happens, what it will mean is that the demand for foreign exchange will reduce and when demand for it reduces ultimately you will find that price will not rise beyond the expectation of Nigerians and we are achieving that.

“Today, we have done a lot in intervention in agriculture. Is it your rice, we have stopped the import of rice. We have stopped import of maize. Right now no foreign exchange for importation of rice or maize, very little amount for wheat.

“I believe that demand will drop as demand drops, what you will find is that whatever supply we have is able to merge with demand and then we can see a stable exchange. That is what we’re trying to do and I imagine that by the time we achieved this, we will continue to engage with World Bank or the IMF”.