President Muhammadu Buhari has inaugurated the National Steering Committee (NSC) of the National Poverty Reduction with Growth Strategy (NPRGS) to be chaired by the Vice President, Professor Yemi Osinbajo.

In his remarks at the event on Tuesday in Abuja, the President reiterated his commitment to lifting 100 million Nigerians out of poverty in 10 years, with a well-researched framework for implementation and funding.

“This journey began in January 2021 when I directed the Chairman of the Presidential Economic Advisory Council and Secretary to the Government of the Federation to collaboratively work together to articulate what will lift 100 million Nigerians out of poverty in 10 years.

“I am happy to note that the process of designing this inclusive poverty reduction strategy recognised and addressed past mistakes, as well as laid the foundation for a sustainable poverty reduction through the wide range consultations held at all levels of government, development partners, the private sector as well as the civil society,” he was quoted as saying by his media aide, Femi Adesina.

President Buhari was confident that the NPRGS would address the underlying causes of poverty on the basis of which it developed programmes that would deal with the multi-dimensional nature of poverty within the practical context of comparative advantage of human and natural resources in the various geo-political zones.

According to him, the major challenge before the committee is to translate the good intention of the government into a positive impact on the average Nigerian in order to create an appreciative impact on the poverty situation in the country.

“If India can lift 271 million people out of poverty between 2006 and 2016, Nigeria can surely lift 100 million out of poverty in 10 years. Fortunately, we have already started but we need to unlock the challenges of slow implementation, inappropriate targeting, and absence of adequate resources,” the President said.

The responsibilities of the committee, he noted, include anchoring collaborative efforts; provide oversight for the implementation of the strategy; provide guidance to Technical Working Group and federal ministries, extra ministerial departments and agencies, subnational governments and other stakeholders on meeting the objectives of the programme; as well as monitor progress and any other effort that would enhance the attainment of the objective of lifting 100 million people out of poverty in 10 years.

“The performance of our economy despite COVID-19 gives me comfort that we can achieve our goal, but we need to seriously scale up and work more with state and local governments.

“This call becomes more pertinent in the face of recent forecasts by the International Monetary Fund, the World Bank and our own Nigerian Economic Summit Group which all agreed that Nigeria needs to frontally tackle her poverty situation if our economic gains are to be sustained,” he told the gathering at the event.

President Buhari asked the committee to commence work immediately to enable the Technical Working Group to begin to put the nuts and bolts together.

He said the responsibilities were onerous but expressed confidence that the committee would be able to lay the foundation and demonstrate, within the next two years, the practicality of lifting 100 million Nigerians out of poverty in or under 10 years.

In his remarks, Vice President Osinbajo said the NPRGS would consolidate other efforts of the government to reduce poverty in the land.

He noted that the President’s position that local governments, states, and the federal government should work jointly to alleviate poverty in the country would be properly reflected in the framework and implementation, stressing the need for access and inclusivity.

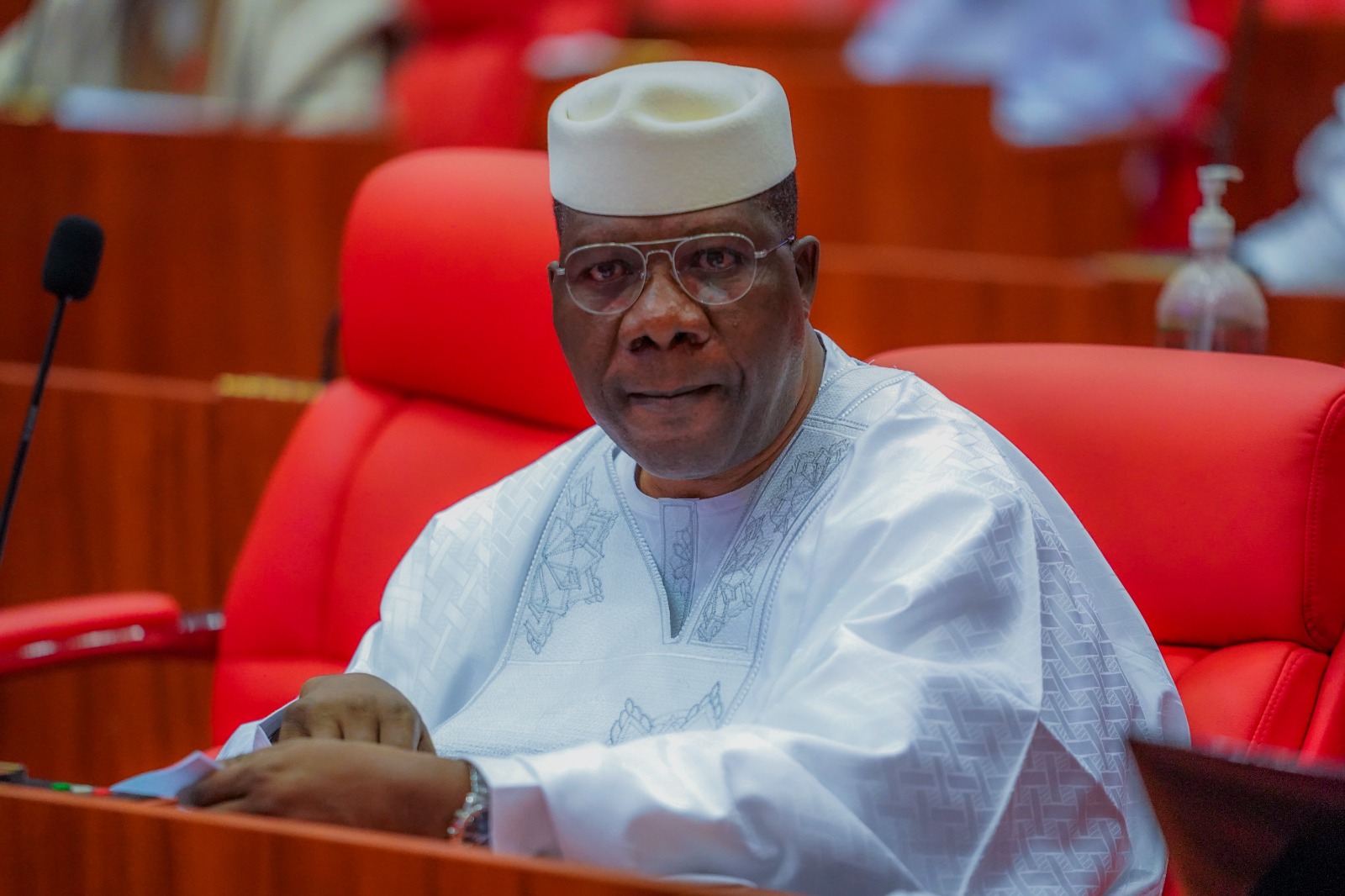

The SGF, Boss Mustapha, who is a member of the committee said the poverty situation in the country assumed an enormous proportion with an increasing population, adding that the situation was compounded by the COVID-19 pandemic.

He, however, said the administration responded to the COVID-19 poverty fallout swiftly and was able to ameliorate the situation and ensured a quick exit from recession.

The committee also has as members Chief of Staff to the President, Governors of Ekiti (South West), Delta (South South), Sokoto (North West), Borno (North East), Nasarawa (North Central), and Ebonyi States (South East).

Others are Ministers of Finance, Budget and National Planning; State for Budget and National Planning; Humanitarian Affairs, Disaster Management and Social Development; Agriculture and Rural Development; Industry, Trade and Investments; Labour and Employment, Education and Health.